What we do with your donations

1. Identify

A mosque makes a request or we identify a mosque that has a specific need.

2. Verify

We carry out an assessment to verify the request to establish a genuine need.

3. Research

We consider suitable options based on feasibility, cost effectiveness and quality.

4. Procure

We independently and directly procure the relevant goods to fulfil the request.

5. Deliver

We photograph the delivery and installation and obtain a testimonial and receipt from the mosque.

6. Publish

We publish the particulars of the request, price quoations, receipts, testominials and photgraphs on our website.

The Messenger of Allah, peace and blessings be upon him, said, “Whoever builds a mosque for Allah, then Allah will build for him a house like it in Paradise.”

Receive a SHARE of the reward whenever someone prays SALAH in the mosque.

Receive a SHARE of the reward whenever someone recites the QURAN in the mosque.

Receive a SHARE of the reward whenever someone does DHIKR in the mosque.

Money Donated

Donators

Requests Fulfilled

Mosques on board

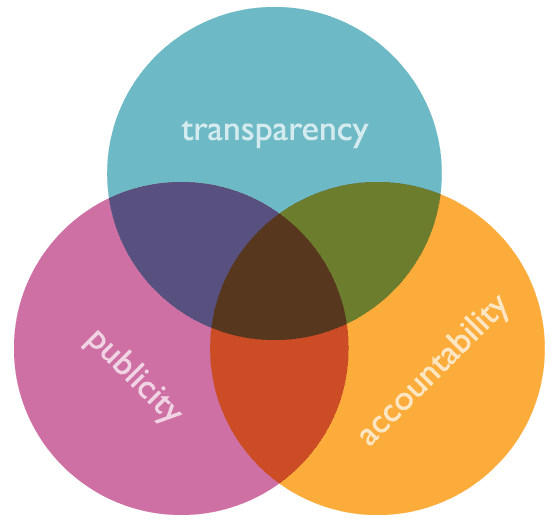

Why we are different

We operate on an ethical basis and ensure that all communication with the public is clear, accessible and honest.

Every penny donated will be used exclusively for the purpose you have specified.

Regular updates on the results of the donations will be sent to the donators and uploaded to this website, this will include invoices and pictures.

Our recent projects

WHERE YOUR DONATIONS ARE SPENT

All money donated by the public is used directly to supply the requested goods and items.

Our trustees bear all advertising, marketing, staff, travel and other costs. All money donated by you is applied directly on fullfiling the needs of mosques.

- PURCHASE AND SUPPLY OF MOSQUE NEEDS – 100%

- ADMIN, STAFF AND TRAVEL – 0%

- MARKETING, ADVERTISING AND OTHER COSTS – 0%

what the mosques say

“Fantastic donation, the Masjid is really appreciative of the support. May Allah reward all those involved…”

“Mashallah, very pleased….”